U of I Investing in Climate Solutions — From the Ground Up

As the dangers of climate change grow more apparent, pressure to end the use of carbon-based fossil fuels has intensified.

The University of Illinois is putting its financial muscle behind efforts to promote renewable fuels as an alternative, with socially responsible investment practices, new eco-conscious fund managers, and a bold new investment in a fund promoting sustainability.

In 2020, the U of I System made the lead investment in BlackRock ESG Insights Strategy, an environmentally and socially focused investment tool from global asset manager BlackRock Inc. The U of I invested $160 million, representing most of the U.S. equity allotment in its $720 million endowment pool and 22 percent of the total.

The move aligns with the new Illinois Sustainable Investing Act, a state law that compels public agencies to implement sustainable investment policies. It’s also consistent with the commitment to sustainability in the university’s Guiding Principles, which call for managing physical and fiscal resources with future generations in mind. That includes assessing the environmental impact of the university’s actions.

“Our sustainability legacy will reflect the effort we put into it. By acting mindfully, we will leave our universities, our state, and our world better than we found it,” the document states.

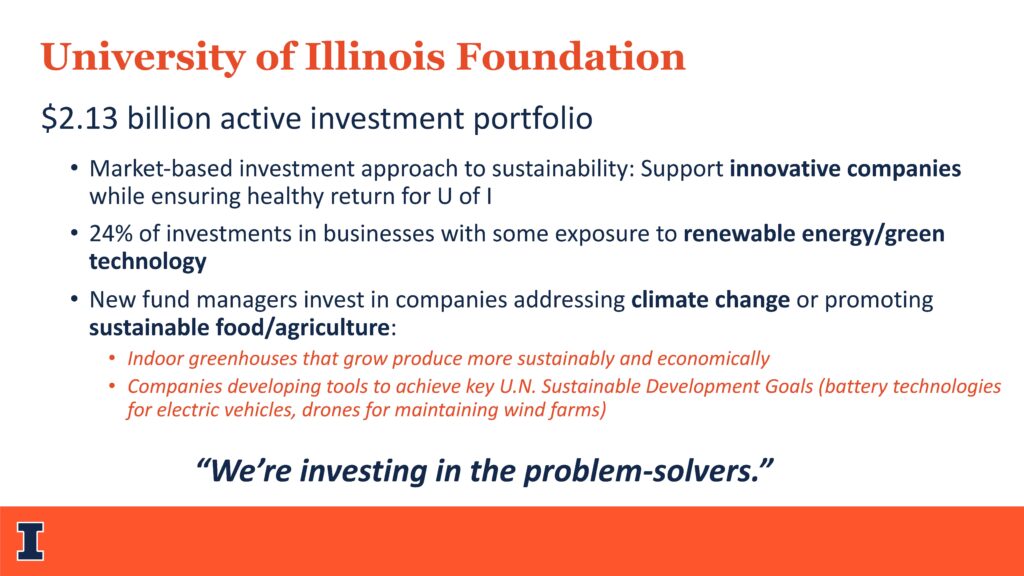

The U of I’s investment assets are managed in two parts. The University of Illinois Foundation, a 501(c) 3 organization, controls the bulk of the endowment, or about $2.2 billion, investing funds given in support of the three universities in Urbana, Chicago, and Springfield.

That process is overseen by an Investment Policy Committee that reports to the Foundation’s board. The U of I System manages a separate investment pool, now up to $762 million, with oversight by the University of Illinois Board of Trustees.

The U of I and the Foundation do not invest directly in any coal or oil companies, as almost all stocks are held through externally managed funds.

The Foundation’s exposure to coal investments is “minimal to nonexistent,” and oil and gas investments are relatively small, said Senior Vice President Barry Benson, who is also Vice Chancellor for Advancement at the University of Illinois Urbana-Champaign.

While the first priority is ensuring a strong financial return for the University, all of the endowment’s external fund managers have socially responsible investment policies in place. They are known as ESG policies, for “environmental, social, and governance,” three key factors that investors can use to measure the sustainability and ethical impact of an investment in a business or company.

Meanwhile, the Foundation is actively engaged in the renewable energy market, at one point investing in the largest wind-power portfolio in the country. About 24 percent of its investments are with businesses that have at least some exposure to renewable energy or green technology.

The Foundation is also hiring new fund managers who, as part of their mandate, will invest in companies solving problems related to climate change or promoting sustainable food and agricultural practices.

One private real estate fund manager invests in controlled-environment food production — huge, solar-powered greenhouses that are leased to farmers who grow fresh produce like peppers, tomatoes, and leafy greens. The system offers both economic and environmental benefits: a 90 percent reduction in water usage, less waste, and yields 14 to 24 times higher than field-grown crops. It also requires fewer chemical fertilizers and pesticides.

One facility next to a natural gas power plant uses carbon recapture technology to take up carbon dioxide and feed the plants, sequestering CO2 in the process. Some of the greenhouses are built close to metropolitan areas, including one 15-acre facility near Minneapolis, saving the costs and carbon emissions involved in shipping produce from California to the Midwest.

Another international public equity manager invests in small to mid-size companies that have proven performance in market sectors affected by ESG regulations and by shifting consumer demand for more sustainable practices. The strategy is to identify companies that are developing technologies, tools, and services to help achieve key U.N. Sustainable Development Goals, including clean water and sanitation, health and well-being, affordable and clean energy, sustainable cities and communities, climate action, and responsible production and consumption.

For example, the fund has invested in companies developing battery technology for electric vehicles and drones for the maintenance of windmills and wind farms.

“Companies with innovative solutions to environmental and social challenges are a target-rich environment for investors looking for quality and growth,” said the Foundation’s interim Chief Investment Officer Edward Creedon.

The Foundation’s pragmatic, market-based approach advances sustainability efforts by supporting companies from the ground up – while ensuring a healthy return for the University.

“We’re investing in the problem-solvers,” Creedon said. “To change behavior, you have to show people that there is a better and also profitable way to solve these problems. There are a lot of smart people out there, and a lot of great ideas to invest in to develop solutions.”’

Illinois Chancellor Robert Jones said efforts to incorporate ESG approaches into the university’s investment decisions are “a very public demonstration of our university commitment to live and operate according to the values we have set out.” In a recent letter to Foundation President Jim Moore, Jones supported the idea of expanding and accelerating those efforts as new opportunities emerge in coming years.

The Illinois Climate Action Plan (iCAP), the campus strategic sustainability plan for achieving carbon neutrality by 2050 or sooner, emphasizes the importance of investments that reflect the U of I’s values and commitment to fight climate change. Read more>>

— Article by Julie Wurth, iSEE Communications Specialist